UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by Party other than Registrant¨

Check the appropriate box:

| ¨ | ||

|

| ¨ |

|

x | Definitive proxy statement |

| ¨ | ||

|

| ¨ | ||

|

FIRST ADVANTAGE CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required

| x | No fee required |

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

¨ Fee paid previously with preliminary materials.

| ¨ |

Dear Stockholders:

I am very pleased to invite you to attend the third2009 annual meeting of stockholders of First Advantage Corporation, a Delaware corporation, to be held atin the Renaissance Vinoy Resort,Eagle Auditorium of our offices, located at 501 Fifth Avenue NE, St. Petersburg, Florida 33701,12395 First American Way, Poway, California 92064, on May 11, 2006April 28, 2009 at 9:00 a.m. EasternPacific Time.

DetailsFor the first time in our company’s history, we are pleased to take advantage of the businessSecurities and Exchange Commission rule allowing companies to be conducted atfurnish proxy materials to their stockholders over the meeting are given inInternet. We believe that this e-proxy process expedites stockholders’ receipt of proxy materials, while also lowering the attached noticecosts and reducing the environmental impact of our annual meetingmeeting. On March 18, 2009, we mailed to our stockholders a Notice containing instructions on how to access our 2009 proxy statement and proxy statement.annual report online.

We hope that you are able to attend the annual meeting. It is important that you vote your shares whether or not you are able to attend in person. We urge you to read the accompanying proxy statement and to vote on the matters presentedyour shares by proxy by filling in the appropriate boxes on the enclosed proxy card and returning it promptly.promptly or by voting over the Internet or by telephone by following the instructions found on the proxy card(s). If you attend the meeting and prefer to vote in person, you may do so even if you have returnedalready voted your proxy card.shares by proxy. You may also revoke a proxy at any time before it is exercised.

Directions to the First Advantage Corporation 2009 Annual Meeting are available on the “Investor Relations” page of our website at www.fadv.com.

Thank you for your cooperation and your support and interest in First Advantage Corporation.

John Long

Chief Executive Officer

|

| Anand Nallathambi |

| Chief Executive Officer and President |

FIRST ADVANTAGE CORPORATION

100 Carillon Parkway12395 First American Way

St. Petersburg, FL 33716Poway, California 92064

NOTICE OF ANNUAL MEETING

To be Held on May 11, 2006April 28, 2009

The 2009 annual meeting of stockholders of First Advantage Corporation, a Delaware corporation, will be held atin the Renaissance Vinoy Resort,Eagle Auditorium of our offices, located at 501 Fifth Avenue NE, St. Petersburg, Florida 33701,12395 First American Way, Poway, California 92064, on May 11, 2006April 28, 2009 at 9:00 a.m. EasternPacific Time, and at any adjournments thereof, for the following purposes:

| 1. | To elect our board of directors to serve until our 2010 annual meeting of stockholders, |

| 2. | To transact such other business as may properly come before the meeting. |

Our board of directors has fixed the close of business on March 31, 200610, 2009 as the record dateRecord Date for determining the holders of our Class A and Class B common stock entitled to notice of the meeting, as well as for determining the holders of our Class A and Class B common stock entitled to vote at the meeting.

All stockholders are invited to attend the annual meeting in person. All stockholders also are respectfully urged to executevote their shares by proxy as promptly as possible by executing and returnreturning the enclosed proxy card as promptly as possible.or by voting over the internet or by telephone by following the instructions found on the proxy card(s). Stockholders who execute avote their shares by proxy card may nevertheless attend the annual meeting, revoke their proxy, and vote their shares in person. Please read the accompanying proxy statement and proxy card for information on the annual meeting and voting.instructions for voting your shares by proxy. Directions to the First Advantage Corporation 2009 Annual Meeting are available on the “Investor Relations” page of our website atwww.fadv.com.

By Order Of The Board Of Directors

Julie A. Waters

| By Order Of The Board Of Directors |

|

| Bret T. Jardine |

Vice President, Associate General Counsel and Corporate Secretary |

| March 18, 2009 |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held April 28, 2009

The Notice of Internet Availability of Proxy Materials includes a toll-free telephone number, an e-mail address and a website where stockholders can request a paper or e-mail copy of the proxy statement, our annual report on Form 10-K for the year ended December 31, 2008 and a form of proxy relating to the annual meeting as well as information on how to access the form of proxy. If you want to receive a paper copy or an e-mail with links to the electronic materials, you must request one by contacting Bret T. Jardine, Corporate Secretary, at 100 Carillon Parkway, St. Petersburg, Florida

April 11, 2006 33716. There is no charge to you for requesting a copy.

FIRST ADVANTAGE CORPORATION

100 Carillon Parkway12395 First American Way

St. Petersburg, FL 33716Poway, California 92064

PROXY STATEMENT

for

annual meetingAnnual Meeting of stockholdersStockholders

May 11, 2006April 28, 2009

The board of directors of First Advantage Corporation is soliciting proxies for use at the annual meeting of stockholders to be held atin the Renaissance Vinoy Resort,Eagle Auditorium of our offices, located at 501 Fifth Avenue NE, St. Petersburg, Florida 33701,12395 First American Way, Poway, California 92064, on May 11, 2006April 28, 2009 at 9:00 a.m. Eastern, Pacific Time, and at any adjournments thereof. On or about April 14, 2006,

As permitted by Securities and Exchange Commission rules, we began sending the attached notice of annual meeting,are making this proxy statement the enclosed proxy card, and our annual report for 2005 (which ison Form 10-K available to our shareholders electronically via the Internet. On March 18, 2009, we mailed to our stockholders a Notice containing instructions on how to access this proxy statement and our annual report online. If you received a Notice by mail, you will not partreceive a printed copy of the proxy soliciting materials)materials in the mail. If you received a Notice by mail and would like to all holders of recordreceive a printed copy of our Class A and Class B common stock entitled to receiveproxy materials, you should follow the instructions for requesting such materials and vote.

contained in the Notice.

Frequently Asked Questions About The Annual Meeting

| Q: | What will be voted on at the annual meeting? |

| A: | The purpose of the annual meeting is to elect our directors for a one-year term and to transact any other business that may properly be presented. |

| Q: | Does First Advantage Corporation have a recommendation on voting? |

| A: | Yes. The board of directors recommends that you vote “FOR” the nominees for director set forth in the attached proxy card. |

| Q: | Who is entitled to vote at the meeting? |

| A: | Holders of record of our Class A common stock and our Class B common stock at the close of business on March |

| Q: | What shares can I vote? |

| A: | You may vote all shares owned by you as of |

| Q: | How many votes will I have? |

| A: | Holders of our Class A common stock will have one vote for each share held of record on |

| Q: | What is the difference between record ownership and beneficial ownership? |

| A: | Most stockholders own their shares through a stockbroker or other nominee rather than directly in their own names. There are some differences in how to vote, depending on how you hold your shares. |

You are the record owner of shares if those shares are registered directly in your name with our transfer agent. The transfer agent for our Class A common stock is Wells Fargo Shareowner Services. First Advantage actsWe act as itsour own transfer agent for our Class B common stock. As the record holder of shares, you may vote such shares in person at the annual meeting or grant your voting proxy directly by completing the enclosed proxy card.

You are the beneficial owner of shares if you hold those shares in “street name” through a stockbroker, bank, trustee or other nominee, including shares held on your behalf in the First Advantage Corporation 401(k) Savings Plan. If you are a beneficial owner, these proxy materials are being sent to you through your stockbroker or other nominee together with a voting instruction card. In order to vote, you must complete the voting instruction card

i

provided by your stockbroker or other nominee to direct the record holder how to vote your shares or obtain a valid proxy from the stockbroker or other nominee who is the record owner of your shares giving you authority to vote your shares in person at the meeting. Directions to the First Advantage Corporation 2009 Annual Meeting are available on the “Investor Relations” page of our website at www.fadv.com.

i

| Q: | What is a notice of electronic availability of proxy statement and annual report? |

| A: | As permitted by Securities and Exchange Commission rules, we are making this proxy statement and our annual report available to our shareholders electronically via the Internet. On March 18, 2009, we mailed to our stockholders a Notice containing instructions on how to access this proxy statement and our annual report online. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the Notice. |

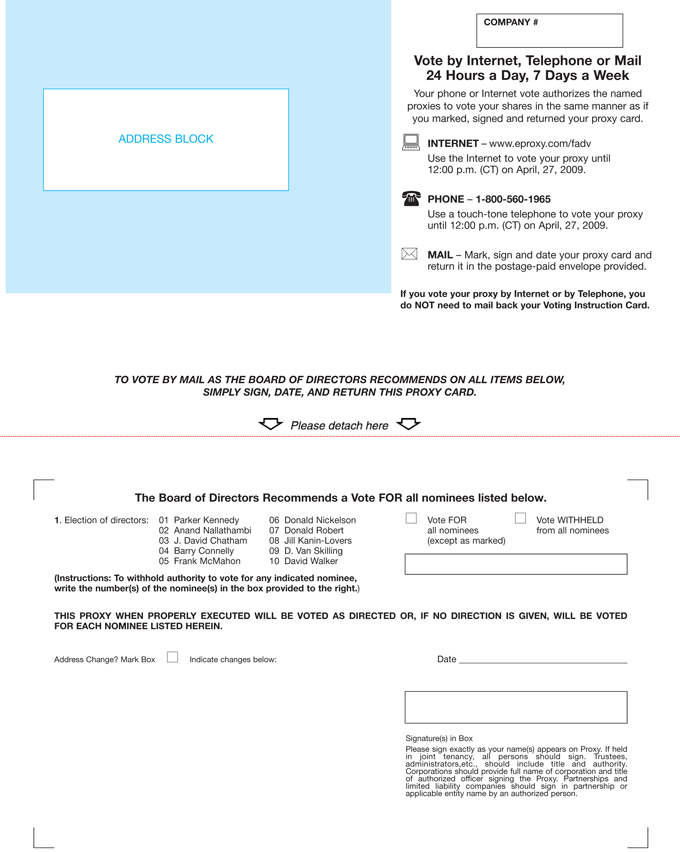

| Q: | How do I vote? |

| A: | You can vote on matters that come before the meeting in two ways: |

You can come to the annual meeting and vote in person; or

You can vote your shares by filling out, signing and returning the proxy card or voting instruction card.proxy.

If you wish to vote at the annual meeting, and you are a beneficial owner of your shares, you must have a legal proxy in your favor executed by the stockbroker or other nominee who is the record owner.

Whether or notIf you plan to attendare the annual meeting in person, please fill inrecord owner of your shares, you may vote your shares by proxy using any of the following methods:

completing, signing, dating and signreturning the enclosed proxy card in the postage-paid envelope provided;

calling the toll-free telephone number listed on the proxy card; or

using the Internet site listed on the proxy card.

The telephone and Internet voting procedures set forth on the proxy card are designed to authenticate stockholders’ identities, to allow stockholders to provide their voting instructions, and to confirm that their instructions have been properly recorded. If you vote by telephone or instruction cardover the Internet, you should not return your proxy card.

If you are a beneficial owner, you will receive voting instructions (including, if your broker, bank or other nominee elects to do so, instructions on how to vote your shares by telephone or over the Internet) from the record holder, and you must follow those instructions in order to have your shares voted at the Annual Meeting.

Depending on how you hold your shares, you may receive more than one proxy card.

Your vote is important. Whether you vote by mail, telephone or over the Internet, your shares will be voted in accordance with your instructions. If you sign, date and return it promptly.your proxy card without indicating how you want to vote your shares, the proxy holders will vote your shares in accordance with the recommendations of the Board of Directors.

| Q: | Can I revoke my proxy? |

| A: | Yes. You may revoke your proxy |

You may send in another proxy card with a later date;

You may notify the secretary ofBret Jardine, our companyCorporate Secretary, in writing before the annual meeting that you have revoked your proxy; or

You may vote in person at the annual meeting.meeting

| Q: | What is the quorum requirement? |

| A: | A quorum of stockholders is necessary to hold a valid meeting. A majority of the outstanding shares of Class A and Class B common stock on |

Shares represented by proxies that withhold authority to vote for a nominee for election as a director or that reflect abstentions or “broker non-votes” (i.e., shares represented at the meeting held by brokers or nominees and to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have the discretionary voting power on a particular matter) will be treated as shares that are present for purposes of determining the presence of a quorum. Abstentions and broker non-votes will not otherwise affect the voting.

| Q: | How will my proxy be voted? |

| A: | Shares represented by |

ii

| Q: | What is the voting requirement? |

| A: | In the election of directors, you may vote “FOR” all of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees. In the election of directors, the persons receiving the highest number of “FOR” votes will be elected. |

| Q: | Who counts the votes cast at the annual meeting? |

| A: | Lisa Steinbach, vice president and controller of our company, acting as the inspector of election, will tabulate votes at the annual meeting. The inspector of election’s duties include determining the number of shares represented at the meeting and entitled to vote, determining the qualification of voters, conducting and accepting the votes, and, when the voting is completed, ascertaining and reporting the number of shares voted, or abstaining from voting, for the election of directors. |

iiiii

PROPOSAL NUMBER ONE

ELECTION OF DIRECTORS

NOMINEES FOR ELECTION OF DIRECTORS

Our charter documents require our entire board of eleven directors to be elected annually. Our board has designated the persons listed below as candidates for election. Each is currently serving as a director. Unless otherwise specified in the proxy card, the proxies solicited by the board will be voted “FOR” the election of these candidates. In case any of these candidates becomes unavailable to stand for election to the board, an event that is not anticipated, the proxy holders will have full discretion and authority to vote or refrain from voting for any substitute nominee in accordance with their judgment.

The terms of directors elected at the annual meeting expire at the 2010 annual meeting to be held in 2007 or as soon thereafter as their successors are duly elected and qualified. The board has no reason to believe that any of the nominees will be unable or unwilling to serve as a director if elected.

Directors are elected by a plurality vote of shares present at the meeting, meaning that the nominee with the most affirmative votes for a particular seat is elected for that seat. If you do not vote for a particular nominee, or if you withhold authority to vote for a particular nominee on your proxy card, your vote will not count either “for” or “against” the nominee.

Ten directors will be standing for election at the annual meeting. None of the nominees has a family relationship with the other nominees, any existing director or any executive officer of our company. Pursuant to the stockholders agreement dated as of December 13, 2002 among First American, FirstMark Capital, L.L.C. (formerly known as Pequot Private Equity Fund II, L.P.) and First Advantage,us, First American and each of its affiliates hashave agreed to vote its shares for one nominee designated by Pequot, whoFirstMark. However, FirstMark has chosen Lawrence D. Lenihan, Jr. as its designee.not designated a nominee to the board of directors.

The board recommends a vote “FOR”“FOR” the election of each nominee listed below.

Parker Kennedy,S. Kennedy.Chairman and Director since 2003.2003, Mr. Kennedy, age 58, was president61, has been the Chairman and Chief Executive Officer of our parent company, The First American Corporation, since 2003. He was President of The First American Corporation from 1993 until 2004,2004. Prior to that time, he served as executive vice president from 1986 to 1993 and was appointed to its board of directors in 1987, and was named chairman and chief executive officer in 2003.1987. Mr. Kennedy has been employed by The First American’sAmerican Corporation’s primary subsidiary, First American Title Insurance Company, since 1977. He was appointed vice presidentVice President of that company in 1979, and in 1981 he joined its board of directors. Duringdirectors in 1981, appointed Executive Vice President in 1983, heand became President in 1989. Mr. Kennedy graduated from the University of Southern California with a Bachelor’s degree in economics, and received his law degree from Hastings College of the Law, San Francisco.

Anand Nallathambi.Director since 2007, Mr. Nallathambi, 47, was appointed executive vice president of First American Title Insurance Company, and in 1989 was appointed its president. He now servesto serve as its chairman, a position to which he was appointed in 1999.

John Long, Chief Executive Officer and Director since 2003. Mr. Long, age 50, has served as chief executive officer of First Advantage since June 2003. Beforein March 2007 and President of First Advantage in September 2005 following First Advantage’s acquisition of the Credit Information Group from The First American Corporation. He serves as a member of the First Advantage acquisition committee. Prior to joining First Advantage, Mr. Long was withNallathambi served as President of The First American since 1990, serving firstCorporation’s Credit Information Group and as senior vice president of sales, then as executive vice president and then presidentPresident of First American Real Estate TaxAppraisal Services Inc. From November 1993from 1996 to March 2000, Mr. Long was president and chief executive officer of First American Real Estate Information Services, Inc., overseeing that company’s strategic and acquisition direction, completing over 40 acquisitions. In March 2000, he became president and chief executive officer of HireCheck, Inc. where he oversaw the acquisition of Substance Abuse Management, Inc., Employee Health Programs, Inc., American Driving Records, Inc., First American Registry, Inc., and SafeRent, all of which are now part of First Advantage. Mr. Long1998. He also serves onas a member of the board of directors of First American Title Insurance Company, a wholly-owned subsidiary of First American.the Consumer Data Industry Association, an international trade association. Mr. Long earnedNallathambi holds a Bachelor of Arts degree from the College of New Rochelle and a Masters degree in business administrationEconomics from HofstraLoyola University in New York.Madras, India, and an MBA from California Lutheran University.

J. David Chatham,Chatham.Director since 2003.2003, Mr. Chatham, age 53, has been a director of58, also serves on the First American since 1989,Advantage Corporation’s audit committee and has been a director of The First AdvantageAmerican Corporation since 2003. Mr. Chatham currently serves as chairman of First American’s1989, and chairs its audit committee and asis a member of its compensation and nominating and corporate governance committees.the executive committee. Since 1989, Mr. Chatham has also been a member of the board of directors of First American Title Insurance Company, since 1989. Since 1972, he has been presidentFirst American’s wholly-owned title insurance underwriter. He is President and chief executive officerChief Executive Officer of Chatham Holdings, Inc.,LLC, a real estate development company. Mr. Chatham graduated from the University of Georgia with a Bachelor of Business Administration degree, majoring in real estate and urban development, and completed the management of family-held corporation program at the Wharton School of Business at the University of Pennsylvania.

1

Barry Connelly,Connelly.Director since 2003.2003, Mr. Connelly, age 65,68, also serves on the First Advantage Corporation’s audit, nominating and corporate governance committees. Mr. Connelly is a credit information consultant to foreign governments and financial services organizations around the world. He is a director on the board of Collection House LTD, a company quotedlisted on the Australian Exchange. Mr. Connelly also serves as the chairman andExchange; a director on the board of Director Rapid Ratings, LTD,Microbilt Corp., a subsidiaryprivately-held credit services company; and also serves on the joint venture board of Collection House LTD.directors of Huaxia/Dun & Bradstreet China. In December 2002, he retired from the Consumer Data Industry Association (“CDIA”) after 33 years of service, including eight years as president. During his tenurePresident. Mr. Connelly graduated from the University of Missouri with CDIA, he was a contributor in drafting the first Fair Credit Reporting Act in 1970 and its successor in 1997.Bachelor of Journalism degree.

-1-

Lawrence Lenihan, Jr.,Jill Kanin-Lovers.Director since 2003. Mr. Lenihan, age 41, was a director2006, Ms. Kanin-Lovers, 57, serves as the chair of US SEARCH.com, Inc. (“US SEARCH”) from September 2000 until June 2003 whenthe First Advantage acquired that company. Mr. LenihanCorporation’s compensation committee and is a senior managing directorpart of Pequot Capital Management, Inc.its nominating and managing general partner and co-head of the Pequot venture funds and the Pequot private equity funds. Previously, Mr. Lenihan was a principal with Broadview Associates, L.L.C. where he was a senior member of the mergers and acquisitions team. Prior to joining Broadview, Mr. Lenihan held various positions within IBM. Mr. Lenihancorporate governance committee. She is also a member of the board of directors for BearingPoint, a global management and technology consulting firm, where she chairs the compensation committee and serves on the nominating and governing committees; Dot Foods, one of Saba Software,the nation’s largest food redistributors, where she chairs the compensation committee and serves on the nominating committee; and Heidrick & Struggles, a leading global search firm, where she chairs the compensation committee and serves on the audit committee. Currently, Ms. Kanin-Lovers teaches “Corporate Governance and Business Ethics” for the Rutgers University Mini-MBA program and “Executive Compensation” for the Rutgers University Global Executive HR Master’s program. Previously, she was Senior Vice President of Human Resources and Workplace Management at Avon Products, Inc., held a Nasdaq-quoted companyseries of senior corporate human resources executive positions at American Express and servesIBM, and began her career in management consulting with Towers Perrin as Vice President and Manager responsible for global compensation practice. Ms. Kanin-Lovers holds a memberBachelor degree from State University of its auditNew York, a Masters degree from the University of Pennsylvania and compensation committees as well as chairmanan MBA from the Wharton School of its governance committee. In addition, Mr. Lenihan serves as a director on several non-public companies, including Duck Creek Technologies, Haley Systems and OutlookSoft. Mr. Lenihan was recommended as a nominee by Pequot Private Equity Fund II, L.P., a holderBusiness at the University of our Class A common stock who is entitled to designate one director that First American and its affiliates are required to vote for under the terms of a stockholders agreement, as amended, which is described in “Certain Relationships and Related Transactions” beginning on page 24.Pennsylvania.

Frank McMahon,V. McMahon.Director since April 2006. Mr. McMahon, age 46, serves as vice chairman and chief financial officer of First American. Prior to joining First American in April 2006, Mr. McMahon, 49, in addition to serving on the board of directors of First Advantage Corporation, serves as the chair of its acquisition committee and serves on its compensation committee. He also serves as the Vice Chairman of The First American Corporation and is Chief Executive Officer of The First American Corporation’s Information Solutions Group. Previously, he was a managing directorManaging Director of the Investment Banking Division withof Lehman Brothers, Inc. and was responsible for managing their western region financial institutions group, as well as their U.S. asset management sector.sector from 1999 to 2006. Prior, to that, Mr. McMahon managedwas a similar group forManaging Director at Merrill Lynch. Mr. McMahon received a Bachelor degree in Economics from Villanova University and his MBA from Duke University.

Donald Nickelson,Nickelson.Director since 2003.2003, Mr. Nickelson, age 73,76, in addition to serving on the board of directors of First Advantage Corporation, chairs its nominating and corporate governance committee and is a member of its compensation committee and acquisition committee. Currently, he serves as a directorVice Chairman and vice chairmanDirector of the leveraged buy-out firm, Harbour Group Industries Inc., and also sits on its executive and compensation committees. In addition, Mr. Nickelson servesa leveraged buy-out firm; as a director of Adolor Corporation, where he servesis a member of the compensation committee and audit committee; on the auditadvisory board of Celtic Pharmaceutical Holdings, L.P.; as Chairman of the advisory board of Celtic Therapeutics; and nominating-governance committee, and serves as a directorChairman of Mainstay Mutual Funds, where he serves on the nominating and audit committees.Cross Match Industries. Previously, Mr. Nickelson also holds directorship positions for several non-public companies, including AddressFree Corporation and Del Industries. Prior to joining Harbour Group, he served as presidentPresident of PaineWebber Group, an investment banking and brokerage firm, from February 1988 to January 1990.and as Lead Trustee of the Mainstay Mutual Funds Group. He has also served on numerous boards, including: as Chairman of the Pacific Stock Exchange; Omniquip International, Inc.; Greenfield Industries; Vie Financial Group; and Flair Corporation.Inc.; as director of the Chicago Board Options Exchange; W.P. Carey & Co., LLC; Royalty Pharma AG; Allied Healthcare Products; DT Industries; Selectide Corporation; and Sugen, Inc.

Donald Robert,Robert.Director since 2003.2003, Mr. Robert, age 46,49, in addition to serving on the board of directors of First Advantage Corporation, is currently chief executive officera member of its compensation committee. He serves as Chief Executive Officer and director of Experian Group, a globalPlc., an information technology company and a wholly owned subsidiary of GUS Plc, a British retailing and consumer information conglomerate.business listed on the London Stock Exchange. Prior to his current appointment, Mr. Robert served as chief executive officerwas Chief Operating Officer and President of Experian North America, and chief operating officer, and president of itsExperian’s Information Solutions business unit beginning in April 2001. From 1995 to 2001, Mr. Robertbefore becoming Chief Executive Officer of Experian North America. Previously, he was a group executiveGroup Executive of The First American Corporation with responsibility for its Consumer Information and Services Group. From 1992 to 1995, Mr. Robert was presidentGroup; President of Credco, Inc., now First Advantage Credco, the nation’s largest specialized credit reporting company and a wholly-owned subsidiarynow part of First Advantage. He isAdvantage Corporation. Mr. Robert holds a member of the GUS Plc board of directors.Bachelor degree in Business Administration from Oregon State University.

Adelaide Sink,D. Van Skilling.Director since December, 2003. Ms. Sink, age 57, currently serves2005, Mr. Skilling, 75, in addition to serving on the board of Raymond James Financial Inc. and Raymond James Bank, where shedirectors of First Advantage Corporation, serves as a member of Raymond James Inc.’s compensation committee, andits audit committee. Mr. Skilling is the President of Skilling Enterprises. He also currently serves as a member of Raymond James Bank’s audit committee, and is an activethe board member of directors for several non-profit organizations, including the Community Foundation of Tampa Bay, Nature Conservancy of Florida and Wake Forest University. Ms. Sink had a 26-year career with Bank of America—Florida, which culminated in her appointment as president from 1993 until 2000.

2

D Van Skilling, Director since November 2005. Mr. Skilling, age 72, currently serves as a director ofcompanies, including: The First American Corporation, where he is lead director and sits on the audit, nominating, corporate governance, and executive committees; Lamson & Sessions, where he chairs the compensation, nomination and governance committees; McData,Onvia, where he is a member ofdirector, chairs the auditcompensation committee, and serves on the nominating and governance committees; Onvia,and American Business Bank, where he is a member of the compensation committee;committee. He retired from his post as Chairman and American Business Bank, where he chairs the compensation committee and is a member of the audit committee. Mr. Skilling formally served as the chairman and chief executive officerChief Executive Officer of Experian Information Solutions, Inc. (formerly TRW Information Systems & Services), following a position he was appointed to26-year career with them. Mr. Skilling earned an MBA in 1996.International Business from Pepperdine University and a Bachelor degree in both Chemistry and Zoology from Colorado College.

David Walker,Walker.Director since 2003.2003, Mr. Walker, age 52,55, in addition to serving on the board of directors of First Advantage Corporation, is the chair of its audit committee and serves on the acquisition committee. Mr. Walker, a Certified Public Account and a Certified Fraud Examiner, is currently serving as the Director of the Programs of Accountancy and Social

-2-

Responsibility and Corporate Reporting in the College of Business at the University of South Florida, St. Petersburg, and is a consultant on corporate governance matters, both roles he has held since 2002. From 1975 through 2002, Mr. Walker was with Arthur Andersen LLP, serving as a partner in the firm from 1986 through 2002.matters. Mr. Walker is also a member of the boards of directors of Chicos FAS, Inc., CommVault Systems, Inc. and Technology Research Corporation, Inc., where he also sits onchairs its compensation committee,committee. Previously, he served as a partner with Arthur Andersen LLP. Mr. Walker earned a Bachelor degree from DePauw University in Economics and Chico’s, FAS.Mathematics, and an MBA from the University Of Chicago Graduate School Of Business.

INFORMATION ABOUT OUR BOARD OF DIRECTORS

Composition of Board and Committees

Our board of directors oversees our business and affairs and monitors the performance of management. Management is responsible for the day-to-day operations of our company. As of the date of this proxy statement, our board has eleventen directors and the following committees: audit, nominating and corporate governance, compensation and special.acquisition. The membership during the last fiscal year and the function of each of the committees are described below. Each of the committees, except the nominating and corporate governance committee, is required to be comprised of three or more members of the board.

We held sevenfive board meetings in 2005.2008. Each director attended at least 75% of all board meetings and applicable committee meetings. We strongly encourage our board of directors to attend our annual meeting of stockholders, and any member who misses three consecutive annual meetings will be removed. The following table lists membership of our board of directors and board committees:

| Committees | ||||||||||||

Name of Director | Audit | Nominating and Corporate Governance | Compensation | |||||||||

Parker Kennedy | ||||||||||||

| X | |||||||||||

J. David Chatham | X | |||||||||||

Barry Connelly | X | X | ||||||||||

| X | X | * | |||||||||

Frank McMahon | X | X | * | |||||||||

Donald Nickelson | X | * | X | X | ||||||||

Donald Robert | ||||||||||||

| X | |||||||||||

D. Van Skilling | X | |||||||||||

David Walker | X | * | X | |||||||||

X=

X = Committee Member; X*= Committee Chair

Independence Matters

Our board has determined that each of our directors is independent within the meaning of applicable NasdaqNASDAQ Stock Market and SECSecurities and Exchange Commission rules, except for ParkerMr. Kennedy, who is chairman and chief executive officer of our parent company, First American; John Long,American, Mr. Nallathambi, who is our chief executive officer;officer and Frankpresident, and Mr. McMahon, who is the vice chairman and chief financialexecutive officer of First American. However,In considering director independence, the board studied the shares of First Advantage common stock beneficially owned by each of the directors as set forth under “Security Ownership of Certain Beneficial Owners and Management,” although the board generally believes that stock ownership tends to further align a director’s interests with those of First Advantage’s other stockholders. In addition, as part of this review, the board considered the fact that Mr. Robert is the chief executive officer of Experian Group, a subsidiary which owns approximately 6.3% of our Class A common stock, and determined that this relationship does not interfere with the exercise of Mr. Robert’s independence from First Advantage and its management.

We are a “controlled company” within the meaning of the NasdaqNASDAQ Marketplace Rules because First American controls more than 50% of theour voting power in First Advantage.power. As such, we are relyingrely on NasdaqNASDAQ Marketplace Rule 4350(c)(5), which allows controlled companies to be exempt from rules requiring (a) the compensation and nominating committees to be composed solely of independent directors; (b) the compensation of the executive officers to be determined by a majority of

3

the independent directors or by a compensation committee composed solely of independent directors; and (c) director nominees to be selected or recommended for the board’s selection either by a majority of the independent directors or by a nominating committee composed solely of independent directors.

-3-

Our independent directors meet in executive session immediately following each regularly scheduled meeting of the board of directors. In addition, our independent directors may meet as they determine appropriate from time to time.

Audit Committee. Our board established the audit committee for the primary purposes of overseeing the accounting and financial reporting processes of our company and audits of our financial statements, and preparing an annual report of the committee.statements. Our board of directors has made an affirmative determination that each member of the audit committee (a) is an “independent director” as that term is defined by NasdaqNASDAQ Marketplace Rules and the rules and regulations under the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act”, and (b) satisfies NasdaqNASDAQ Marketplace Rules relating to financial literacy and experience. Our board of directors has further determined that DavidMessrs. Chatham and Walker satisfiessatisfy the criteria for being an “audit committee financial expert” as such term is defined in Item 401(h)407(d)(5) of Regulation S-K promulgated by the SEC.Securities and Exchange Commission.

The audit committee is solely responsible for selecting First Advantage’s our independent registered certified public accounting firm (“independent public accountants;accountants”); approving in advance all audit services and related fees and terms; and approving in advance all non-audit services, if any, provided by our independent public accountants and related fees and terms. The audit committee also oversees and monitors our internal control system, evaluates the independence standards forof our outside auditors, reviews the conduct of and personnel inindependent public accountants, oversees our internal audit function, reviews financial information in our quarterly reports, and reviews and evaluatesoversees the audit performed by our outside auditors.independent public accountants. The committee reports any significant developments with respect to its duties to the full board. The audit committee met 13nine times during 2005.2008. Our board of directors has adopted a written audit committee charter a(a copy of which is attached to this proxy statement as Appendix A. The audit committee charter may also be viewed in the Corporate Governance page of the Investor Relations section of our website located at www.fadv.com. For more information regarding the audit committee, see “Report of the Audit Committee of the Board of Directors” on page 7 of this proxy statement.

Compensation Committee. The compensation committee is responsible for recommending compensation arrangements for officers of our company; evaluating the performance of our company’s chief executive officer; administering our company’s compensation plans, and preparing annual and other reports of the committee. Each member of the committee is a non-employee director. The compensation committee met 9 times in 2005. The compensation committee charter may be viewed on the Corporate Governance page of the Investor Relations section of our website located at www.fadv.com. For additional information regardingwww.fadv.com or a printed copy may be obtained by making a written request to Bret T. Jardine, Corporate Secretary of First Advantage Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716).

Compensation Committee. The compensation committee is responsible for recommending compensation arrangements for our executive officers; evaluating the performance of our chief executive officer; and administering our compensation plans. Except for Mr. McMahon, all members of the compensation committee see “Reportare independent under the standards for independence established by the applicable NASDAQ Marketplace Rules. The compensation committee met nine times during 2008. Our board of directors has adopted a written compensation committee charter (a copy of which may be viewed on the Corporate Governance page of the Investor Relations section of our website located at www.fadv.com or a printed copy may be obtained by making a written request to Bret Jardine, Corporate Secretary of First Advantage Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716). The compensation committee establishes and reviews our overall compensation philosophy. The committee reviews the performance of our chief executive officer and has the sole authority to determine his compensation and reviews and approves the salary of our other executive officers. The committee reviews and recommends to the board for approval our incentive and equity compensation plans, oversees those who are responsible for administering those plans and approves all equity compensation plans that are not subject to stockholder approval. The compensation committee also has the authority to retain compensation consultants as it deems necessary and the sole authority to approve such consultant’s fees. When setting executive officer compensation, in the first quarter of each year, the Chief Executive Officer presents a report to the compensation committee containing his recommendation of the upcoming year’s salary, bonus and long-term incentive award levels for certain executive officers other than himself. The committee takes the Chief Executive Officer’s report under advisement and meets with its own compensation consultant. To obtain objective compensation information, in 2008 the compensation committee engaged Mercer LLC as its compensation consultant. The committee has the full authority to manage all aspects of Mercer’s engagement, including approving Mercer’s compensation on a monthly basis and the ability, in the compensation committee’s sole discretion, to terminate the engagement. Examples of projects assigned to the consultant included the evaluation of the composition of the peer group of companies used to evaluate appropriate compensation levels, evaluation of levels of executive compensation as compared to general market compensation data and the peer companies’ compensation data, and evaluation of proposed compensation programs or changes to existing programs.

The compensation committee believes that both management and the consultant provide useful information and points of view to assist the compensation committee in determining its own views on compensation. Although the compensation committee receives information and recommendations regarding the design of the compensation program and level of compensation for the executive officers from both the consultant and management, the compensation committee makes the final decisions as to the design and levels of compensation for these executives.

The compensation committee uses the chief executive officer’s report, together with reports that may be prepared by its consultant, to set executive officer salaries and bonuses for the upcoming year. Executive officers are not present during compensation committee or board of directors deliberations concerning their compensation. The chairman of the board is present when setting the chief executive officer’s salary and bonus.

Compensation Committee Interlocks and Insider Participation. The members of the Boardcompensation committee for 2008 were Ms. Kanin-Lovers and Messrs. McMahon, Nickelson and Robert. As noted above, Mr. McMahon is a Vice

-4-

Chairman of DirectorsFirst American, our parent company. None of our executive officers have served on Executive Compensation” on page 17the board of this proxy statement.directors or compensation committee of any other entity that has or has had one or more executive officers who served as a member of our board of directors or our compensation committee during the 2008 fiscal year.

Nominating and Corporate Governance Committee. Our board of directors has established a nominating and corporate governance committee to (i) assist the board in identifying individuals qualified to become directors and recommending to the board for nomination of candidates for election or reelection to the board or to fill board vacancies.vacancies, (ii) develop and recommend to our board a set of corporate governance principles and (iii) lead the board in complying with those principles. All members of the nominating committee are independent under the standards for independence established by the applicable NASDAQ Marketplace Rules. The nominating and corporate governance committee met two times in 2005.twice during 2008.

The nominating and corporate governance committee acts under a written charter adopted by our board of directors (a copy of which may be viewed inon the Corporate Governance page of the Investor Relations section of our website located at www.fadv.com)www.fadv.com or obtained by making a written request to Bret T. Jardine, Corporate Secretary of First Advantage Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716) specifying, among other things, the following minimum qualifications for candidates recommended for election to the board:

impeccable character and integrity;

the ability to communicate effectively with members of the board, management, auditors and outside advisors;

a willingness to act independently;

substantial experience in business, with educational institutions, governmental entities or non-profit organizations;

the ability to read and understand financial statements and financial analysis;

4

no criminal history or a background which could reasonably be expected to damage the reputation of our company;

does not currently serve as a director, officer or employee of, or a consultant to, a direct competitor of our company; and

does not cause our company to violate independence requirements under applicable law or the NasdaqNASDAQ Marketplace Rules.

The nominating committee also will consider, among other factors, whether an individual has any direct experience with our company or its subsidiaries (whether as a director, officer, employee, supplier or otherwise); the individual’s experience in the industry in which our company operates; the individual’s other obligations and time commitments; whether the individual is an employee of a company or institution on thehaving a board of directors ofon which a senior executive of our company serves; whether the individual has specific knowledge, skills or experience that may be of value to our company or a committee of the board; whether an individual has been recommended by a stockholder of our company, an independent member of the board, another member of the board, senior management of our company or a customer of our company; and the findings of any third parties that may be engaged to assist the committee in identifying directors.

The nominating and corporate governance committee regularly assesses the appropriate size of the board and whether any vacancies on the board are anticipated. Various potential candidates for director are then identified. Candidates may come to the attention of the committee through current board members, professional search firms, stockholders or industry sources. In evaluating the candidate, the committee considers factors other than the candidate’s qualifications, including the current composition of the board, the balance of management and independent directors, the need for audit committee expertise and the evaluations of other prospective nominees. In connection with this evaluation, the committee determines whether to interview the prospective nominee, and if warranted, one or more members of the committee, and others as appropriate, interview prospective nominees. After completing this evaluation and interview, the committee makes a recommendation to the full board as to the persons who should be nominated by the board, and the board determines the nominees after considering the recommendation and report of the committee.

The nominating and corporate governance committee recommended the slate of directors proposed for election at the annual meeting, which was unanimously approved by the full board of directors, including unanimous approval by the independent directors. Lawrence Lenihan, Jr. was recommended as a nominee by Pequot Private Equity Fund II, L.P., a holder

As part of our Class A common stock who is entitled to designate one director that First Americanits role in developing and its affiliates are required to vote for undercomplying with corporate governance policies, the terms of a stockholders agreement.

Special Committee. In January 2005,nominating and corporate governance committee advises the board of directors formed a special committee comprised of independent directors forand the purpose of evaluatingvarious committees on effective management and leadership, reviews the acquisitiongoverning documents of the Credit Information Group (“CIG”) from First American. The committee is not currently active.company (including our certificate of incorporation, bylaws, corporate governance policies and guidelines and code of conduct), provides ongoing advice with respect to conflicts of interest that may arise, and evaluates the current and future governance needs and obligations of the company, our board and the committees in light of “best practices” developments.

-5-

Procedure for Stockholder Nominations of Directors

Nominations for the election of directors may only be made by the board of directors in consultation with its nominating and corporate governance committee. AAs noted above, FirstMark may designate a nominee to the board of directors under the terms of the stockholders agreement dated as of December 13, 2002 among First American, FirstMark Capital and us. However, FirstMark has not designated a nominee to the board of directors. In addition, a stockholder of record who has the power to vote ten percent or more of the outstanding capital stock of our company may recommend to the nominating committee up to one candidate for consideration as a nominee in any 12-month period. The nominating committee will consider a stockholder nominee only if a stockholder gives written notice to the secretaryBret T. Jardine, Corporate Secretary of our companyFirst Advantage Corporation, at our principal executive offices100 Carillon Parkway, St. Petersburg, Florida 33716 not later than the close of business on November 1 of the year immediately preceding the year of the annual meeting of stockholders at which the stockholder desires to have his or her candidate presented byto the board. Each such notice must include the name, address and telephone number of the potential nominee; a detailed biography of the potential nominee; and evidence of stock ownership by the presenting stockholder, including the number of shares owned. Nominees properly proposed by eligible stockholders will be evaluated by the nominating and corporate governance committee in the same manner as nominees identified by the committee. To date, no stockholder or group of stockholders having the power to vote ten percent or more of our capital stock has put forth any director nominees.

Stockholder Communications

Our stockholders may communicate directly with the members of the board of directors or individual members by writing directly to it or those individuals,them in care of the secretaryBret T. Jardine, Corporate Secretary of our companyFirst Advantage Corporation, at our principal executive offices, together with100 Carillon Parkway, St. Petersburg, Florida 33716. Stockholders are required to provide appropriate evidence of their stock ownership. We strongly encourageownership with any communications. Communications received in writing are distributed to our board ofor to individual directors to attend our annual meeting of stockholders,as appropriate depending on the facts and any member who misses three consecutive annual meetings will be removed.circumstances outlined in the communication received.

Code of EthicsCODE OF CONDUCT

First Advantage hasWe have adopted a code of ethicsconduct that applies to itsour chief executive officer, chief financial officer, controller and all of itsour other officers, employees and directors. Adirectors (a copy of our code of ethicswhich may be viewed inon the Corporate Governance page of the Investor Relations section of our website located at www.fadv.com.

5

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the compensation committee for fiscal 2005 were Messrs. Lenihan, Nickelson and Robert and Ms. Sink. No member of this committee was at any time during the 2005 fiscal yearwww.fadv.com or at any other time an officer or employeeobtained by making a written request to Bret T. Jardine, Corporate Secretary of First Advantage and no member had any relationshipCorporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716).

BUSINESS RELATIONSHIPS AND RELATED TRANSACTIONS

Relationships with First American

We effectively commenced operations on June 5, 2003 with our acquisition of First American’s screening technology division and US SEARCH.com, Inc. As consideration for these acquisitions, we issued 100% of our outstanding Class B common stock to First American and 100% of our Class A common stock to former stockholders of US SEARCH.com, Inc. Each share of our Class B common stock entitles the holder to ten votes in any meeting of stockholders. As a result, First American received approximately 80% of the outstanding capital stock of our company and approximately 98% of the voting power in our company. Former stockholders of US SEARCH.com, Inc. received the remaining approximately 20% of our outstanding capital stock. FirstMark, formerly a stockholder of US SEARCH.com, Inc., received approximately 10% of our Class A common stock in the transaction. First American and FirstMark entered into a stockholders agreement concurrently with the acquisitions that granted FirstMark certain registration rights and the right to sell shares of our Class A common stock at the same time First American sells any of our shares under certain circumstances, and generally requires First American to vote for one nominee for director designated by FirstMark. As a controlled subsidiary of First American, we have various relationships with First American, which are described below.

We entered into a reimbursement agreement dated October 11, 2005 with First American whereby we reimburse First American for the actual expenses incurred by us in connection with the participation by certain of our employees in First American’s supplemental benefit plan. In 2008, we reimbursed First American $400,055 for actual and interest costs for Anand Nallathambi’s participation in the supplemental benefit plan.

-6-

On November 7, 2005, we entered into an operating agreement with a subsidiary of First American that sets forth the terms under which we, along with the First American subsidiary, jointly own and operate LeadClick Holding Company, LLC. We have ownership of 70% of LeadClick Holding Company LLC, with the remaining 30% being owned by the First American subsidiary.

First American provides certain legal, financial, technology, administrative and managerial support services to us pursuant to a service agreement that was entered into on January 1, 2004. Under the terms of the service agreement, human resources systems and payroll systems and support, network services and financial systems are provided at an annual cost of approximately $0.3 million. In addition, certain other services including pension and 401(k) expenses, corporate and medical insurance, personal property leasing and company car programs are provided at actual cost. The initial term of the agreement was for one year, with automatic self renewals every six months. First American incurred approximately $8.5 million in service fees for the year ended December 31, 2008.

First American and certain of its affiliates provided sales and marketing, legal, financial, technology, leased facilities, leased equipment and other administrative services to the Credit Information Group. As part of our 2005 acquisition of the Credit Information Group from First American, we entered into an amended and restated services agreement with First American on September 14, 2005. Under the terms of this agreement, First American provides human resources systems and payroll systems and support, network services and financial systems at an annual cost of approximately $4.5 million. In addition, First American provides certain other services (including pension and 401(k) expenses, corporate and medical insurance, personal property leasing and company car programs) at actual cost. The initial term of the agreement was for one year, with automatic self renewals every six months. The amounts allocated to the Credit Information Group are based on management’s assumptions (primarily usage, time incurred and number of employees) as to the proportion of the services used by the Credit Information Group in relation to the actual costs incurred by First American and its affiliates in providing the services. The company incurred approximately $4.5 million in service fees for the year ended December 31, 2008.

We also have an agreement with the First American Corporation dated September 14, 2005 to lease the Credit Information Group’s office space in Poway, California. The lease has an initial term of five years with a one-time option to renew the term for an additional five years. The rent payable under the lease is approximately $169,000 per month, and we are obligated to pay all costs and expenses related to the property, including operating expenses, maintenance and taxes, which were approximately $2.0 million for the year ended December 31, 2008.

Effective January 1, 2003, we entered into an agreement with a subsidiary of First American whereby we act as an agent in selling renters insurance. We receive a commission of 12% of the insurance premiums and 20% of the profits (as defined in the agreement) of the insurance premiums written. Commissions earned in 2008 were approximately $2.5 million.

We also perform employment screening, credit reporting and hiring management services for First American. Total revenue from First American was approximately $4.1 million for the year ended December 31, 2008.

First American Real Estate Solutions, LLC (“FARES”), a joint venture between First American and Experian, owns 50% of a joint venture that provides mortgage credit reports and operations support to a nationwide mortgage lender. In accordance with the terms of the joint venture operating agreement, the mortgage and consumer credit reporting operation of FARES receives a merge fee per credit report issued and is reimbursed for certain operating costs. In connection with the acquisition of the Credit Information Group, FARES entered into an outsourcing agreement where we continue to provide these services to the nationwide mortgage lender. These earnings totaled $5.3 million for the year ended December 31, 2008. Effective January 1, 2008, the Company entered into two agreements (Computer License agreement and a Service Agreement) with Rels Reporting Services, LLC which replaced the original agreements that had provided for charging merge fees on credit reports issued and the reimbursement of the majority of operating costs. These new agreements incorporate a transaction fee and a fixed fee for services, and minimize the reimbursement of operating costs. This management fee is included in service revenue and was $9.8 million for the year ended December 31, 2008. The residual reimbursement for operating costs were $0.4 million for the year ended December 31, 2008.

We, through a subsidiary, perform tax consulting services for First American pursuant to a training grants & incentives services agreement which was entered into in August 2007. We identify grants and tax credits, and match them with First American’s training curriculum and complete the necessary applications as a part of the service offering. Our fees for the training grant services are payable at twenty percent (20%) of the total amount of each approved training grant arranged by us for the benefit of First American. As of this date, there has been no significant revenue recognized under this agreement.

We, through a subsidiary, provide publicly available bankruptcy information to First American pursuant to a data license and information services agreement dated December 27, 2007. The annual fee for these services is $75,000 ($6,250 per month).

-7-

Our Lender Services segment has partnered with First American CoreLogic (“FACL”) through a series of agreements to provide major national lender consumer data from the FACL databases in a Fair Credit Reporting Act compliant method. In 2008, we purchased data from FACL for a total of $1.9 million.

We have a flood zone determination wholesale service provider agreement, dated March 1, 2008, between First American Hazard Certification LLC, a subsidiary of First American and First Advantage requiring disclosureCredco, LLC. Under the terms of this agreement, we are permitted to resell flood products provided by First American to First Advantage Credco’s end-user customers. All product costs and pricing are market-based.

We entered into a hiring management license and service agreement, dated January 11, 2008, between a subsidiary of ours, First Advantage Enterprise Screening Corporation, and First American. Under the terms of the agreement, we will license hiring management solution software to First American and provide certain services and maintenance for the software. The fees for this agreement will be an annual fee of $305,000 (invoiced quarterly). The parties, however, have agreed to suspend performance of this agreement until such time that First American determines to proceed with its previously announced spin-off of a portion of its business.

Relationships with Experian

Experian owns approximately 6.3% of a combination of First Advantage’s Class A and Class B common shares and is considered a related party. The cost of credit reports purchased by us from Experian was $24.9 million for the year ended December 31, 2008. We sell background and lead generation services to Experian. Total revenue from these sales was $0.1 million for the year ended December 31, 2008. We have also entered into a registration rights agreement in September 2005 (and which was amended in November 2005) with Experian pursuant to which we have agreed, under certain terms and conditions, to register shares of our Class A common stock that Experian owns.

Related Party Transaction Approval Policy

It is our policy that the audit committee review and approve in advance all related party transactions that are required to be disclosed pursuant to Item 404 of Regulation S-K. No executiveS-K promulgated by the Securities and Exchange Commission. If advance approval is not feasible, the audit committee must approve or ratify the transaction at the next scheduled meeting of the committee. Transactions required to be disclosed pursuant to Item 404 include any transaction between First Advantage and any officer, director or certain affiliates of First Advantage that has serveda value in excess of $120,000. In reviewing related party transactions, the audit committee evaluates all material facts about the transaction, including the nature of the transaction, the benefit provided to First Advantage, whether the transaction is on commercially reasonable terms that would have been available from an unrelated third-party and any other factors necessary to its determination that the transaction is fair to First Advantage. Our board of directors or compensation committeehas adopted a written Statement of any other entity that has or has had one or more executive officers who served as a memberPolicy With Respect to Related Party Transactions (a copy of which may be viewed on the Corporate Governance page of the boardInvestor Relations section of directorsour website located at www.fadv.com or the compensation committeea printed copy may be obtained by making a written request to Bret T. Jardine, Corporate Secretary of First Advantage during the 2005 fiscal year.Corporation, at 100 Carillon Parkway, St. Petersburg, Florida 33716).

6

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

In the performance of its oversight function, the audit committee has met and held discussions with management of First Advantage, who represented to the audit committee that our company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles. The audit committee has reviewed and discussed the consolidated financial statements with both management and our company’s registered certified public accountants, PricewaterhouseCoopers LLP. The audit committee also discussed with our company’s registered certified public accountants matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as currently in effect.

Our company’s registered certified public accountants also provided to the audit committee the written disclosures required by the current version of Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the audit committee discussed their independence with the independent public accountants. In connection with that, the audit committee has considered whether the provision of non-auditing services (and the aggregate fees billed for these services) in fiscal 2005 by PricewaterhouseCoopers LLP to First Advantage is compatible with maintaining the registered certified public accountants’ independence.

Based upon the reports and discussions described in this report, the audit committee recommended to the board of directors that the audited consolidated financial statements be included in our company’s annual report on Form 10-K for the fiscal year ended December 31, 2005, filed with the SEC.

By the Audit Committee of the Board of

Directors

/s/ DAVID WALKER

David Walker, Chairman

J. David Chatham

Barry Connelly

D. Van Skilling

7

EXECUTIVE OFFICERS

(Listed in alphabetical order)

Our executive officers, in addition to Parker Kennedy and John LongAnand Nallathambi are listed below:

Anand NallathambiEvan Barnett, 44, president since September 2005. Following the acquisition of the CIG from First American, Mr. Nallathambi was appointed61, president of First Advantage.our multifamily services segment since 2003. Previously, Mr. Barnett held senior management positions with Omni International Corporation and related entities, including positions as CFO and Executive Vice President. Prior to joining First Advantage,his tenure with Omni International, he was employed as a certified public accountant with Grant Thornton LLP. Mr. NallathambiBarnett served as president of First American’s Credit Information Groupthe National Association of Screening Agencies from 2000 to 2003. Mr. Barnett holds agent licensure for property and as presidentcasualty insurance. He graduated from The American University with a Bachelor of First American Appraisal Services from 1996 to 1998. Mr. Nallathambi receivedScience degree in accounting and a mastersmaster’s degree in business administration from California Lutheran University after obtaining a bachelor of arts degree in economics from Loyola University in Madras, India.financial management.

Akshaya MehtaBret T. Jardine, 46,42, was appointed Vice President, Associate General Counsel and Corporate Secretary in October 2008 and has been with the company since 2004, acting as Corporate Secretary since 2006. Prior to joining the company, Mr. Jardine was a partner in the law firm of Zimmet, Unice, Salzman, Heyman and Jardine PA. and has been practicing law for nearly 20 years. Mr. Jardine received his undergraduate degree from the University of Florida and his law degree from Stetson University College of Law.

-8-

John Lamson, 58, chief operatingfinancial officer and executive vice president since 2003. Prior to joining the company, Mr. Lamson served as chief financial officer of First American Real Estate Information Services Inc., a wholly-owned subsidiary of First American, a position he held from September 1997 to June 2003. Prior to joining First American, Mr. Lamson spent over five years as a self-employed consultant. Prior to that, Mr. Lamson served as chief financial officer of a financial institution and as a certified public accountant with Arthur Andersen Co. Mr. Lamson is a member of the American Institute of Certified Public Accountants and holds a Bachelor of Arts degree in business administration from the University of South Florida.

Andrew Macdonald, 45, was appointed senior vice president of corporate development in September 2007 and continues to serve as president of the First Advantage Investigative and Litigation Services segment, a position he has held since January 2005. Mr. Macdonald joined the company in 2002 through the HireCheck, Inc. acquisition of Employee Health Programs, Inc. where he served as president and chief financial officer. Following the acquisition, Mr. Macdonald served as president of First Advantage Occupational Health Services Corp. and then as vice president and corporate development officer for First Advantage. He is a member of the Oxford College Board of Counselors. Mr. Macdonald received his Bachelor of Arts degree in business administration from Emory University.

Todd Mavis, 47, joined the company as executive vice president-operations on August 1, 2007. Prior to joining the company, Mr. Mavis served as president and chief executive officer of Danka Business Systems from April 2004 to March 2006, having joined Danka Business Systems in 2001. From 1997 to 2001, Mr. Mavis was executive vice president of Mitchell International, a leading information provider and software developer for insurance and related industries. From 1996 to 1997, Mr. Mavis was senior vice president—worldwide sales and marketing of Checkmate Electronics, Inc. Mr. Mavis holds a Bachelor of Arts degree in marketing and administration from the University of Oklahoma and a masters degree in business administration from San Diego State University.

Akshaya Mehta, 49, has been the executive vice president-corporate infrastructure since August 2007. From 2003 to August 2007, Mr. Mehta served the company as chief operating officer and executive vice president. Previously, Mr. Mehta served as executive vice president and chief operating officer of American Driving Records, (“ADR”)Inc., a wholly-owned subsidiary of First Advantage,ours. Mr. Mehta has over 15 years of management experience and over 20 years of technology development expertise. Prior to joining ADRAmerican Driving Records, Inc. in 1999, Mr. Mehta served as division vice president of product development at Automatic Data Processing, Inc., vice president of development at Security Pacific Bank, and Deputy Head of Development at UBS London. Mr. Mehta earned a masters degree in computer science at the Imperial College of the University of London after obtaining a bachelorBachelor of scienceScience degree in physics and medical physics from Queen Elizabeth College of the same university.University of London.

John LamsonThomas Milligan, 55, chief53, was appointed Vice President and Corporate Treasurer in 2003. He previously served as Treasurer of First American Real Estate Information Services, Inc. which he joined in January 1998. Among other duties, Mr. Milligan manages the corporate treasury function, and other financial officermanagement, planning and executive vice president sincerelated analysis for the company. Prior to 1998, Mr. Milligan was Director of Finance for IMC Mortgage Company. Before joining IMC, he provided acquisition financing with Household Commercial Finance and worked in the Chicago office of Deloitte & Touche. Mr. Milligan received his undergraduate business degree from the University of Florida and an MBA from Keller Graduate School of Management. He is also a Certified Public Accountant.

Lisa Steinbach, 45, was appointed Vice President and Corporate Controller in 2003. Prior to joining First Advantage, Mr. Lamson served as chief financial officerthe company, Ms. Steinbach was Controller of First American Real Estate Information Services Inc., a wholly-owned subsidiaryposition she held since joining the company in 1997. Other prior experience includes over 12 years of First American, a position he held from September 1997 to June 2003. Prior to that, Mr. Lamson served as chief financial officerincreasing responsibility with certified public accountants Cherry Bekaert and Holland, Alfa Romeo Distributors of a financial institutionNorth America, and asEckerd Corporation. Ms. Steinbach is a certified public accountant with Arthur Andersen & Co. Mr. Lamson is a member of the American Institute of Certified Public Accountantsin Florida and holds a bachelor of arts degree in business administration from the University of South Florida.

Julie Waters, 39, joined First Advantage in April 2004 as vice president and general counsel. Prior to joining First Advantage, Ms. Waters was general counsel for USA Floral Products, Inc., formally a publicly traded company on NASDAQ. Ms. Waters was previously employed as in-house counsel for Teco Corporation and Spalding & Evenflo Corporation. Ms. Waters received her juris doctorate from George Washington University after receiving a bachelor of arts degree in English and Rhetoric & Communications from the University of Virginia.

Alan Missen, 43, chief information officer since March 2005. Prior to joining First Advantage, Mr. Missen was with PricewaterhouseCoopers LLP, first as director of shared services applications and most recently as director of portfolio management. Before joining PricewaterhouseCoopers LLP, Mr. Missen was a senior information technology manager with Arthur Andersen LLP. Mr. Missen has more than 20 years of experience in information technology. Mr. Missen holds a bachelor of science degree in statistics from the University of Toronto.

Evan Barnett, 58, president of multifamily services segment since 2003. Previously, Mr. Barnett held senior management positions with Omni International Corporation and related entities from 1974 through December 1994. He was employed as a certified public accountant with Grant Thornton LLP (then Alexander Grant & Co) from 1970 to 1974. Mr. Barnett graduated from The American University with a bachelor of science degree in accounting and a master’s degree in business administration in financial management.

Bart Valdez, 43, president of employment services segment since 2003. Mr. Valdez was named president of HireCheck, Inc. in October 2002 after joining the company in October 2000 as chief operating officer. From August 2001 until October 2002, he also served as president of Substance Abuse Management, Inc. (“SAMI”). From June of 1998 until he joined HireCheck, Mr. Valdez served as vice president of business development and operations for Employee Information Services, Inc. (“EIS”). HireCheck, SAMI and EIS are now part of First Advantage’s employment services segment. He received his bachelor of scienceAccounting degree from ColoradoFlorida State University and his master’s degree in business administration from the University of Colorado.University.

8-9-

Andrew MacDonald, 42, joined First Advantage in 2002 throughSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below sets forth information, as of March 10, 2009, concerning (a) each person who is known to us to be the acquisitionbeneficial owner of Employee Health Programs by Hirecheck, now part of First Advantage’s employment services segment, where he was president and chief financial officer. Following the acquisition, Mr. MacDonald served as both presidentmore than 5% of First Advantage Occupational Health ServicesCorporation’s Class A common stock and then as vice presidentClass B common stock; (b) each of our named executive officers; (c) each director; and corporate development officer. In January 2006, Mr. MacDonald was appointed president of First Advantage Litigation Consulting, LLC, part(d) all of the investigativedirectors and litigation support services segment. Mr. MacDonald received his bachelor of arts degreeexecutive officers as a group. Unless otherwise indicated, to our knowledge, all persons listed below have sole voting and investment power with respect to their shares, except to the extent spouses share authority under applicable law. Beneficial ownership is determined in business administration from Emory University.

Howard Tischler, 53, joined First Advantage in September 2005 throughaccordance with the acquisition of CIG from First American and currently serves as the presidentrules of the dealer services segmentSecurities and Exchange Commission. In computing the number and percentage of shares beneficially owned by a person, shares that may be acquired by such person within 60 days of March 10, 2009 are counted as outstanding, while these shares are not counted as outstanding for computing the company. Prior to joining First Advantage, Mr. Tischler served as chief executive officer and presidentpercentage ownership of First American CMSI, a company acquired in connection with the acquisition of the CIG from First American Corporation. Mr. Tischler received his bachelor of science degree in mathematics from the University of Maryland and his masters of science degree in engineering and operations research from the George Washington University.

Isabelle Thiesen, 45, joined First Advantage as chief security officer in October 2005. Prior to joining First Advantage, Ms. Thiesen served as vice president of information security for Warner Bros. Prior to Warner Bros., Ms. Thiesen served in security positions for Universal Studios, American Express and Ernst & Young. Ms. Thiesen has a masters of science degree in business administration from California State Polytechnic University after having received a bachelor of arts degree in mass media communication and film studies from the University of Utah.any other person.

9

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS